Is the Inflation Reduction Act (IRA) impacting drug development investing? Maybe not.

There have been many discussions about the IRA and the fact that large and small molecules have different timelines for becoming eligible for price negotiations with the Centers for Medicare and Medicaid Services (CMS). Large molecules have four more years before negotiations start. The assumption is that drug development investment will trend towards large molecules because of a greater potential ROI and negatively impact clinically valuable small molecule research and development.

I have yet to see data-based evidence that this is happening.

Big Pharma is generally secretive about their pre-clinical development pipelines, and sunk costs would favor continuing with anything already in the clinic that has promising data. So, determining what Big Pharma is doing is difficult. However, many executives have said that they are rebalancing their pipelines to favor large molecules. For example, Pfizer’s Suneet Varma, Commercial President of Pfizer Oncology, said a in late February investor call, “Biologics represent a more durable revenue potential based on a number of factors, including differentiated access and affordability to the patient, IRA considerations, and patent expiration timeline.”

But with limited access to Big Pharma pipeline data, it is difficult to do a true data-based analysis.

Following the Money

I took a different approach by looking at what the venture capital (VC) community is investing in. There have been anecdotal analyses based on VC investor commentary that they will also be favoring large molecules more due to the IRA. But why rely on that when we have real data?

IPM has a database of startup companies with VC rounds greater than $20 million. The IRA passed in August 2022, so I accounted for a few months for deals already in the pipeline and analyzed the 2023 database for U.S.-based PharmaBio companies (143 deals total) on small versus large molecule investment. If concerns about the IRA were on investors’ minds, you would expect to see a downward trend in small molecule investment through 2023.

But that is not happening.

While investments for large molecules are higher than for small molecules, the trend of small molecule investment is not dropping. If anything, it is going up. This is both in total dollars and as a percentage of total investment.

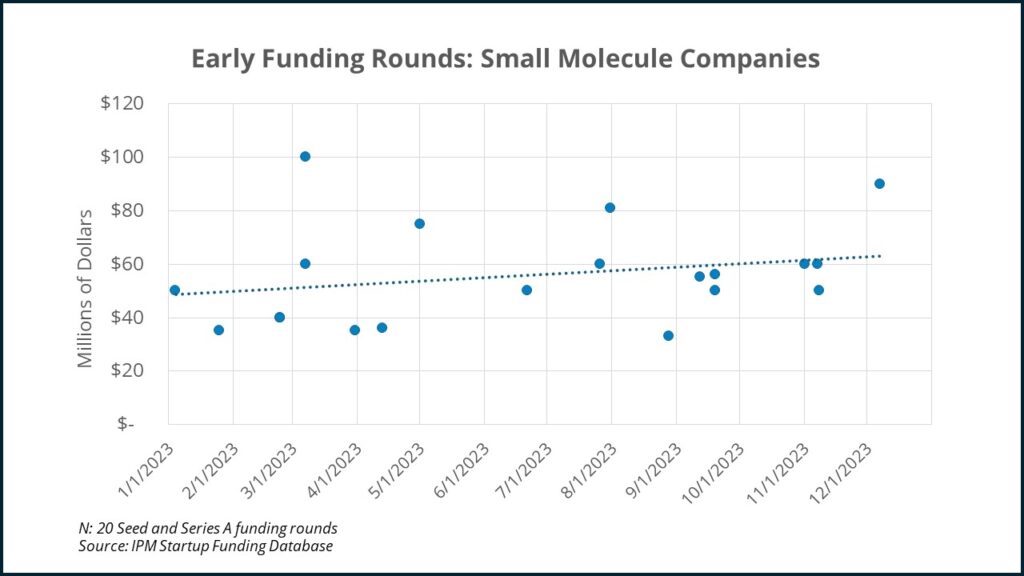

Since sunk costs could again be part of the result, with VC’s reinvesting in companies they put funding into before the IRA was passed, let’s look at just the early (Seed and Series A) funding rounds:

Again, while the trendlines are not statistically significant, there definitely doesn’t seem to be a drop off in small molecule early funding rounds.

What Conclusions Should We Draw from This?

Despite anecdotal commentary, the venture capital community’s trend in small versus large molecule investing was not impacted by the IRA distinction between large and small molecules in 2023. While VCs have a different ROI timeline from Big Pharma, and frequently recoup their money by selling a company or doing an IPO before commercialization, you would still think that the long-term ramifications of the IRA would influence them.

Maybe the VCs figure the law will be changed (as many in the pharmaceutical industry are calling for) and eliminate the different treatment for large versus small molecules. Regardless, if the IRA was going to have an impact on VC investing, we should have seen it by now. While it might be a part of their decision-making, it looks like the more important variables to the VCs are the leadership team, intellectual property and competitive position, and development risk.

We’ll watch this interesting trend as the IRA legislation continues to roll out and impact the pharma/biotech world.

June 24, 2024

"*" indicates required fields